Financial independence is the point at which your savings or other sources of passive income are enough to cover your living expenses without relying on a wage. For some, it’s about retiring early, whereas for others it might mean having enough security to work less or travel the world. In short, financial independence means different things to different people, and your definition will shape how much you need.

But how much would it take for the average household to reach a point where they can consider themselves to be financially independent? To help find the answer, we’ve looked at average annual household spending across the UK, the typical value of household debt and what a comfortable emergency fund would be.

Using these figures, we’ve calculated how much would be required to fund 25 years of financial independence in retirement.

We’ve also calculated how much people of different ages would need to save right now to remain financially independent up until the age of 90, helping to paint a clearer picture of what it would take for different generations to never have to work again.

The 25x rule: A starting point for financial freedom in retirement

If your goal is retirement at 65 or beyond, the 25x rule is a useful starting point for planning financial freedom. This rule suggests you need around 25 times your annual spending saved to maintain your lifestyle for 25 years.

However, this is only an estimate based on your current spending, so you’ll need to make adjustments if your spending habits shift over time. For example, outgoings such as travel costs might decrease as you get older and you spend more time at home, however utility costs may increase as a result. Alternatively, you might want to travel and take more holidays as you get older, meaning your savings pot may need to be larger.

Additionally, if you plan to retire early, you will also need to save more to ensure your pot lasts for a longer time period. You may also want to plan for the possibility that you could outlive your savings. Investing, maintaining disciplined savings habits, and contributing to a pension are practical ways to grow your retirement pot and work towards long-term financial independence.

If you’re unsure about the best strategy for your goals and current financial situation, it’s always a good idea to speak with a financial advisor who can help you create a plan tailored to your needs.

What would 25 years of financial independence in retirement cost?

Achieving long-term financial independence requires more than simply covering your day-to-day expenses. It can involve addressing debts, preparing for unexpected costs, and ensuring there’s enough saved to comfortably maintain your lifestyle well into the future.

So, how much would UK households actually need to make the dream of a financially independent retirement a reality? To find out, we analysed average household spending, typical levels of debt, and what’s needed for a rainy day fund. We then applied the 25x rule to household spending, a guideline that suggests you need 25 times your annual spending to achieve long-term financial security.

We also considered two key factors within our calculation in order to arrive at a realistic target for lasting financial freedom in retirement:

- Inflation – We calculated this at a rate of 2.88% each year, an average based on historical inflation in the UK.

- Interest or investment returns – We assumed a 5% annual return on savings or investments to estimate how much households would need today to fund 25 years of spending, withdrawing only what’s needed each year.

Using this methodology, we’ve calculated that in order to achieve financial independence for 25 years, the average household would need approximately £743,338 saved by the end of 2025. This figure covers 25 years of future living expenses, clears existing household debt, and includes a rainy day fund for emergencies.

Here’s how that looks broken down:

- The average UK household spends £31,653 a year on essentials like utilities, food, transport, and leisure. With prices rising at 2.88% a year (based on historical inflation), that adds up to £1,168,765 million over 25 years. However, if your savings benefited from 5% annual interest, either in a savings account or investment, you’d only need around £613,605 saved today. This assumes starting withdrawals of £32,565 in 2026, increasing with inflation each year.

- But sustaining a financially independent lifestyle also means addressing liabilities. Currently, the average UK household carries £121,525 in debt (including remaining mortgage debt).

- On top of this, emergency funds are recommended to help cover six months of essential expenses, which would currently be around £8,207 on average. It’s important to note that this is an estimation and is based on 2025 spending. If you have an emergency fund, you should regularly assess this figure if your expenses change and prices rise.

Added together (25 years of living expenses, paying off all existing debts upfront, and setting aside a rainy day fund) the total cost over time comes to £1,298,498, but thanks to the power of compound interest (following an average of 5% interest), you’d need to save £743,338 to cover it all for 25 years.

How your personal circumstances affect the cost of financial freedom in retirement

The path to financial independence will depend heavily on your spending habits and the lifestyle you’re accustomed to. As a result, this will impact the amount needed to cover expenses for 25 years of retirement.

According to household spending by income level, the lowest 10% of earners will need approximately £381,107 saved for 25 years of retirement after adjusting for savings interest and inflation.

On the other hand, households with higher-than average expenditure will face a steeper target. A household in the top 10% of earners will need as much as £1,322,483 to achieve financial freedom for 25 years of retirement, with interest and inflation applied. And for households somewhere in the middle, an average of £706,167 is estimated as the total amount needed.

This range highlights just how personal the journey to financial independence can be depending on your circumstances. Achieving it requires a clear understanding of your own lifestyle, financial obligations, and long-term aspirations, and aligning your savings or investing goals accordingly.

If you’re looking to achieve financial independence, it’s always best to speak with a financial adviser first. They can help you create a plan that is tailored to your own circumstances.

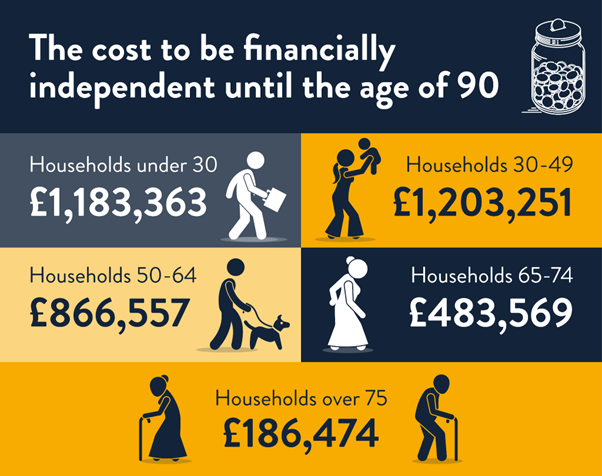

How much lifelong financial freedom could cost depending on your age

For many, especially those just embarking on the journey of adulthood, 25 years of financial freedom might not be long enough. So, how much would you need to save up now to enjoy a lifetime of financial independence?

If you’re younger, you’ll face more years of rising prices due to inflation, but you also have more time to grow your money through the power of compound interest. Taking this into account, alongside generational household spending habits and debt per age group, we’ve calculated how much different groups would need in the bank right now, depending on their current age, in order to achieve financial freedom up until the age of 90.

To achieve lifetime financial independence, strong financial planning is key. For example, consider a diversified portfolio of investments, managing earnings and outgoings, and having a clear financial strategy for making your savings pot last as long as you need it to. Investing, in particular, can help your savings work harder and last for a longer period of time.

Under 30

For those aged 18-30, lifelong financial freedom means funding a much longer period – potentially over six decades – while also accounting for the long-term effects of inflation.

Assuming consistent spending habits, and an average yearly inflation rate of 2.88%, an average of £1,001,042 would be required right now to cover annual living expenses until the age of 90. However, this rises to £1,183,363 when factoring in paying debt off upfront (including the average remaining mortgage debt and household debt for people in this age bracket), as well as a six month emergency fund.

From 30s and 40s

For adults in their 30s and 40s, the financial target increases slightly. While they have fewer years to fund compared to younger adults, they also have less time to grow their savings through interest.

At the same time, this age group typically has the highest levels of household spending – a cost that is expected to rise annually with inflation. Factoring in average annual expenses, existing debt and a six-month emergency fund, the estimated amount needed to be financially independent until the age of 90 is approximately £1,203,251.

From 50s – mid 60s

Those in their 50s and early 60s – nearing the traditional retirement age – will find the financial burden fairly lighter. The amount needed right now to be financially independent until the age of 90 for this generation is around £866,557, a significant drop from that of younger age groups.

Retirement age and beyond

Even for those reaching retirement age, the dream of financial freedom is still a goal for many. In fact, over one million Brits are still working beyond the state pension age, which is currently 66, and more are expected to continue in employment into their later years.

For people aged 65 to 74, the amount needed to be financially independent up until 90 is approximately £483,569. For those over 74, with even fewer years to reach 90 years old, and the lowest average living costs and debt, the amount needed drops dramatically to just £186,474 on average.

It’s important to note that the above figures are based on current expenditure for households of each age group. Whilst they do consider inflation, if you plan to do a lot of travelling or make additional big purchases, you would need to grow your savings pot further to accommodate for this.

Manageable ways you can work towards achieving financial independence

Financial freedom is often viewed as the ultimate financial milestone. It’s the point where your money works for you, rather than the other way around. The benefits are clear: reduced stress, increased flexibility in your career if you decide to continue working, the option to retire on your own terms, and freedom to spend more time on the things you value most.

Unfortunately, the reality is that full financial independence remains out of reach for many people, especially amid rising living costs. However, the principles that underpin financial freedom apply to anyone who wants to make the most of their financial situation. Even if you don’t reach the ultimate goal, working towards financial resilience can still transform your financial wellbeing.

With that in mind, Derence Lee, Chief Finance Officer at Shepherds Friendly shares some realistic and actionable steps to help reduce debt and build your wealth:

1. Plan effectively and set realistic milestones for saving

While full financial independence for a lifetime may not be achievable for everyone, financial stability and control are smaller goals we should all be able to work towards. The key is to start with realistic goals – like becoming debt-free or investing regularly – and build from there.

Part of planning effectively is estimating your future costs and considering the best places to keep your money. For example, emergency savings are likely best kept in easy-access accounts so you can take funds out quickly if needed. For medium- to long-term goals, like a house deposit or a new car, ISAs offer a better balance of flexibility, as well as growth potential thanks to any interest earned being tax free.

Additionally, pensions are vital for planning a financially secure retirement. Pensions are a longer-term, tax-efficient way of saving for the future and often come with employer contributions. However, if you’re hoping to retire early, ISAs can help bridge the gap until your pension becomes accessible.

Ultimately, financial freedom can be less about a magic number and more about having a clear, strategic plan for the future.

2. Tackle your debt – starting with high-interest debt

Debt can be one of the biggest barriers to financial independence, so addressing it can be a crucial first step. Start by listing all your outstanding debts and consider what the best strategy would be to start paying them off. A common and effective strategy is to focus on paying off high-interest debts first, as these cost you more over time.

Knowing where to start when it comes to tackling debt can be overwhelming. If you’re unsure, you may wish to speak to a financial adviser, as they can help you to find ways to tackle your debt that suit your current situation.

3. Build a safety net with an emergency fund

An emergency fund, usually covering 3-6 months of your essential expenses, can offer security if you face unexpected costs such as car repairs or the loss of employment.

Start small and gradually build your fund over time as even modest savings can help to prevent you falling back into debt when the unexpected happens. For added peace of mind, you might want to consider taking out income protection insurance. This insurance can help provide you with a regular income if you’re unable to work due to illness or injury, helping you maintain financial stability, while an emergency fund can help support immediate needs.

4. Diversify your financial portfolio to help protect your savings from inflation

Leaving savings in a standard account can mean they lose purchasing power over time. A Stocks & Shares ISA, for example, offers a tax-efficient way to diversify your financial portfolio, allowing you to invest in a wide range of assets – such as index funds, bonds, and equities – while protecting your returns from income and capital gains tax.

Over the long term, a Stocks and Shares ISA can help you build your personal wealth beyond what you would have saved in a regular savings account, therefore helping to protect your savings from inflation.

5. Reduce or remove unnecessary expenses

Reviewing your finances regularly can help you spot areas where you might be overspending. This doesn’t mean giving up everything you enjoy – but small changes can add up. Cancelling unused subscriptions, switching utility or insurance providers, or renegotiating bills can free up hundreds of pounds a year.

You can then use those savings towards paying off debt or boosting your emergency fund. Even small adjustments to your budget can have a big impact over time.

Sources & Methodology

Shepherds Friendly calculated the total cost of financial freedom per household expenditure, and age group based on the following:

- Average household expenditure – ONS – Since the most recent data for this was from 2023, average inflation rates for 2024 and 2025 (so far) were applied to find the estimated household expenditure in 2025.

- Household debt per income type – ONS – Once again, this has been adjusted for inflation as the most recent data available is from 2022.

- Household debt per age range – ONS – Since the most recent data available is from 2020, inflation has been applied.

- 6 month emergency fund – This was calculated as half the annual spend on necessities: food & non-alcoholic drinks, clothing & footwear, housing, fuel & power, health and communication. Please note that this is reflective of 2025 prices and will need to be adjusted accordingly year on year, depending on inflation.

To calculate the cost for 25 years of financial freedom, the 25X rule was applied – estimating the lump sum needed to generate enough passive income to cover annual spending without running out of money for 25 years, including paying off debt and having an emergency fund.

For the average amount needed for middle income households, an average was taken for fifth and sixth percentile income households.

To calculate the cost of financial freedom until the age of 90, the median age of each group was taken and from this, the number of years until reaching 90 years old. Household expenditure was then multiplied by the number of years remaining until they reach 90, before household debt and emergency funds were added.

An assumed inflation rate of 2.88% (the average annual inflation rate since 1989) was applied each year to annual expenditure to account for the national inflation over this time.

An assumed interest rate of 5% (the average nominal interest rate) was applied to the initial investment amount, accounting for annual withdrawals for expenditure costs.

Please note that the research does not take into account existing pensions or investment assets, or their interest potential. Having these can help reduce the amount needed to save in order to be financially independent.

Inflation and interest have not been applied to existing debt or emergency savings.