Opening an ISA (Individual Savings Account), is a smart way to save for your future. These savings plans allow adults and parents on behalf of their children to save tax-efficiently up to a maximum annual amount, known as an ISA allowance. Find out everything you need to know about ISAs, including the updated allowances for 2020/21.

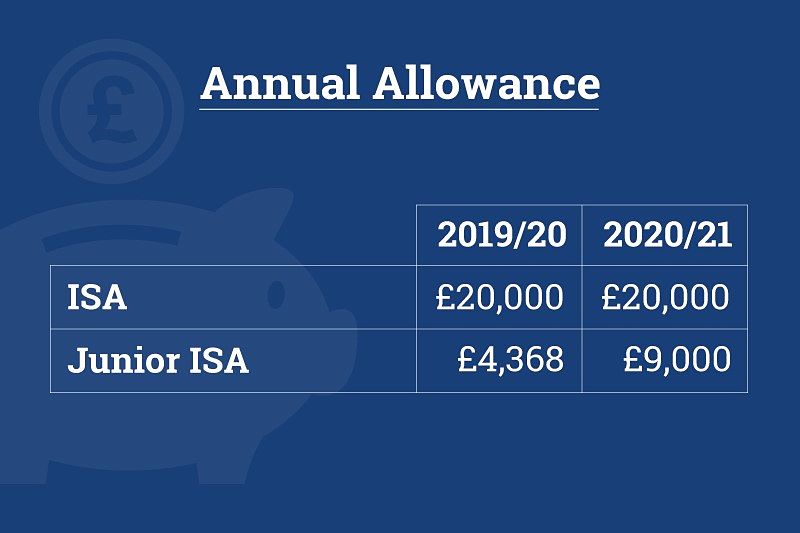

ISA allowances for 2020/21

For another year, adult ISA allowances have remained frozen at £20,000. However, Junior ISA allowances have been given a generous increase from £4,368 to £9,000.

This new figure will also apply to Child Trust Funds. The Government’s Budget document explains the rationale that prompted this significant rise:

“By saving towards their future, families can give children a significant financial asset when they reach adulthood – helping them into further education, training, or work.”

With the new allowance, Shepherds Friendly members will have the choice to save more than ever into their children’s Junior ISAs, while still maintaining the flexibility to save from just £10 a month.

How ISA allowances work

Your ISA allowance is the maximum total amount that you can save tax-free in any given year.

This refreshes annually; when the new tax year arrives, so does your new allowance. (The tax year ends on 5th April, with the new one starting on 6th April.) This means that you have 12 months to make the most of your tax-free allowance; it doesn’t carry over into the next year.

There are five different types of ISA (more on this later), you can use your full allowance in one cash ISA, Stocks and Shares ISA, or split it between multiple accounts. The important thing to remember is that you can only put money into one of each type of ISA throughout any one tax year.

It’s worth noting that how much you can save in one account depends on the type of ISA. So, it’s always wise to double check this before you start saving. For example, a Help to Buy ISA has a monthly allowance of £200 per month, whereas a Lifetime ISA has an annual £4,000 limit.

The different types of ISA

An ISA can fall under one of five categories:

• Cash ISA

• Stocks and Shares ISA

• Sustainable Stocks and Shares ISA

• Lifetime ISA

• Innovative Finance ISA

From these core ISA types, we get the different types of savings accounts you can open, these include:

• Cash ISA: This is an ISA in its simplest form and is a completely tax-free way to save. While Cash ISAs have proven popular, the low interest rates have prompted savers to start exploring their options. Cash ISAs are a low risk way to save, but due to the low rates of interest (often around 1% or less), you’re unlikely to see much of a return on your savings.

• Stocks and Shares ISA: As the name suggests, with this type of ISA, your money is invested in stocks and shares, property, gilts, bonds and even cash. Historically the returns on Stocks and Shares ISA tend to be better over the long-term than with Cash ISAs, although this cannot be not guaranteed. As Stocks and Shares ISAs depend on the performance of your investment, your returns can go down as well as up, so it’s important to take a longer-term outlook when investing. There may be a fee for managing your account too, which is normally a percentage of the money you have invested.

• Sustainable Stocks and Shares ISA: The Sustainable Stocks and Shares ISA is very similar to a Stocks and Shares ISA, with the key distinction being the way the funds are invested. As stated in the name, the Sustainable Stocks and Shares ISA is more sustainable with the funds being invested with companies which aim to make a positive contribution to society.

• Junior ISA: Junior ISAs give parents and guardians a way to save for a child’s future, with the funds becoming accessible on their 18th birthday. Many choose to save long-term for their children in order to help towards things like university, buying their first car or home, or travelling. There are both stocks and shares and cash options for Junior ISAs, so you can take your pick.

• Help to Buy ISA: Help to Buy ISAs were launched to help first-time buyers with saving for a house deposit. The main benefit of this type of account is the government bonus; savers receive 25% boost on their savings when they purchase their first home. While existing Help to Buy ISA holders can continue to save up to £200 a month and claim their bonus, it is no longer possible to open a new account. Help to Buy ISAs fall into the Cash ISA category, meaning that you cannot save into another Cash ISA alongside it.

• Lifetime ISA: Similar to the Help to Buy ISA, the Lifetime ISA also gives a 25% boost on savings, but some limitations apply. You must open your ISA between the ages of 18 and 39. In addition to this, you will not receive the 25% bonus if you withdraw your money before you are 60, unless it is for the purchase of your first home. You have an annual allowance in the Lifetime ISA of up to £4,000, and you can have a Stocks and Shares or Cash version of this. Also, you can save with a Lifetime ISA alongside any other type of ISA, providing that you do not exceed your £20,000 allowance.

• Innovative Finance ISA: The Innovative Finance ISA, otherwise known as an IFISA, is a crowdfunding product meaning you’re often investing in high risk but high potential areas. An IFISA involves peer-to-peer (P2P) lending investments instead of investing in cash or stocks and shares. Through an IFISA provider, you can lend money to businesses, property developers and other projects and receive tax-free interest on repayments. Interest rates are usually quite high, but these types of investments tend to carry greater risk.

While you are under no obligation to use your full annual allowance, it’s usually wise to try and make the most of as much of it as you can. After all, you’re saving to build a brighter future for yourself and your loved ones! There are a number of ways to maximise your savings, including opening additional ISAs (in line with ISA rules), increasing your premiums or topping up your ISA.