Shepherds Friendly Society conducted a survey questioning 2,000 parents on their attitudes towards saving for their children and found that of those who would like to save, a third (32.8%) would like their children to put the savings towards a deposit on their first home.

According to the Office for National Statistics, for first-time buyers, the average deposit as a percentage of the purchase price increased by almost 10 percentage points between 1988 and 2013, from 12 per cent to 22 per cent. [2]

Today, the majority of lenders ask for at least a 10% deposit for a mortgage loan, with the average 10% deposit for UK first-time buyers in 2016 standing at £17,677. If a parent wanted to provide/gift their children with savings for a housing deposit, and they were to save £50 a month from the date of birth of their child, it would take 29.5 years to save enough for the average UK first-time buyer deposit.

So what might the average deposit be in 20 years time, and how are our children today going to be able to fund it when they reach adulthood? We take a look at what house prices are like now, how they might be in the future and ways in which parents can start saving towards a deposit, below.

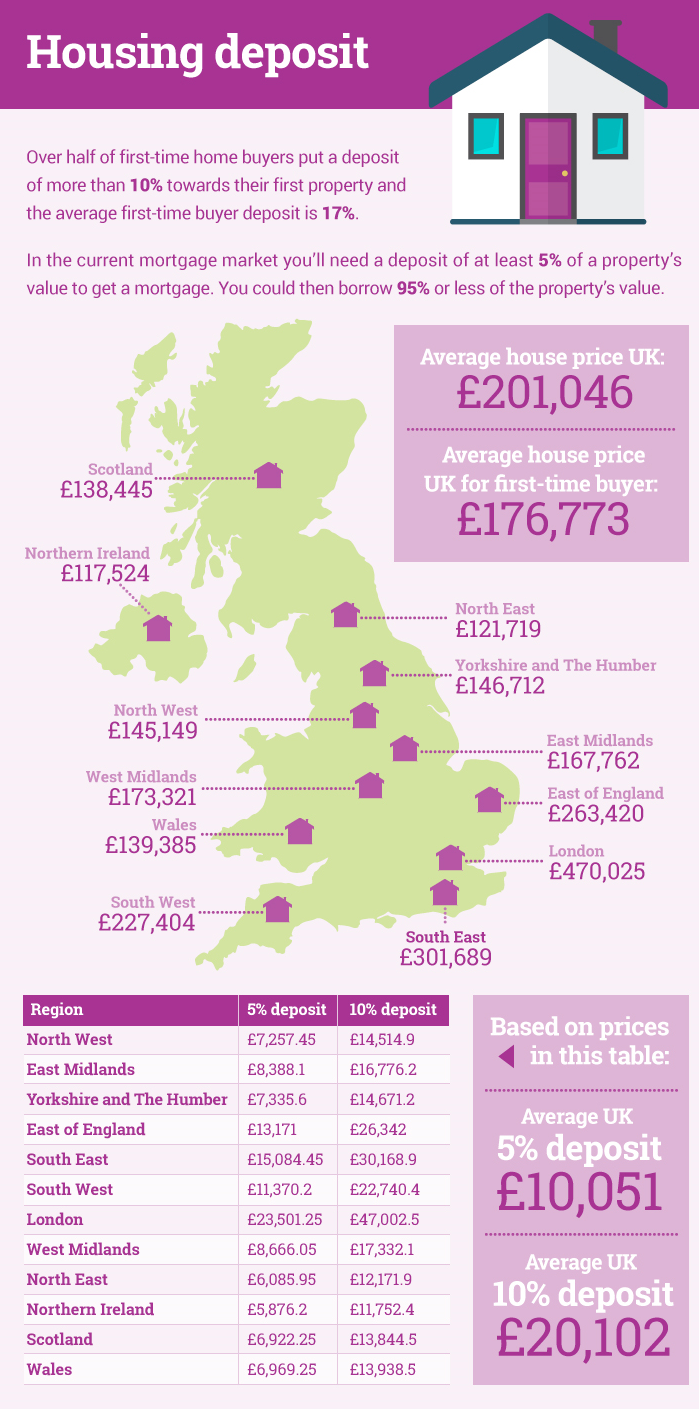

Find the average 5% and 10% deposit of house prices in your area in 2016:

Help to buy scheme

The struggle faced by young adults to get onto the property ladder hasn’t gone unnoticed by the government and they have introduced the Help to Buy Scheme, which means first-time buyers could only need an initial 5% deposit.

The average 5% deposit for homes in the UK in 2016 is £10,051. At £50 a month it would take 17 years for parents to save for the 5% deposit, which seems much more affordable, and realistic, to many.

There are arguably disadvantages of the Help to Buy Scheme though, such as the loan being increasingly expensive, the fact that you are limited to a new build home and that there is a danger of negative equity.

How much might our children need for a house deposit?

In August 2006, the average house price was £172,037 [3] and the average house price today is £201,046; an increase of 16.86%. No-one can tell what future increases will be, if any, but, if we assume a similar increase, the average house price would be £234,942 in 10 years time, and in 20 years it could be £274,553.

If parents were to increase their savings to £100 a month from the birth of their child, they could save £20,400 by the time their child was 17 years old without any investment growth which would cover an average 10% deposit in today’s housing market. However, bearing in mind a similar rise in house price growth over the next 20 years as in the previous 10, you would need an extra £7,350 on top to accumulate a deposit for the average house. Investing could help to bridge this gap, with annual bonuses or growth added to parent’s investments to help to bring them closer to their target.

If you are interesting in saving for your children to help them raise a housing deposit, you can start saving tax-efficiently today in our Junior ISA.

Sources

[1] Shepherds Friendly Survey based on 2,000 parents in UK

[2] http://visual.ons.gov.uk/uk-perspectives-housing-and-home-ownership-in-the-uk/

[3]http://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/housepriceindex/june2016